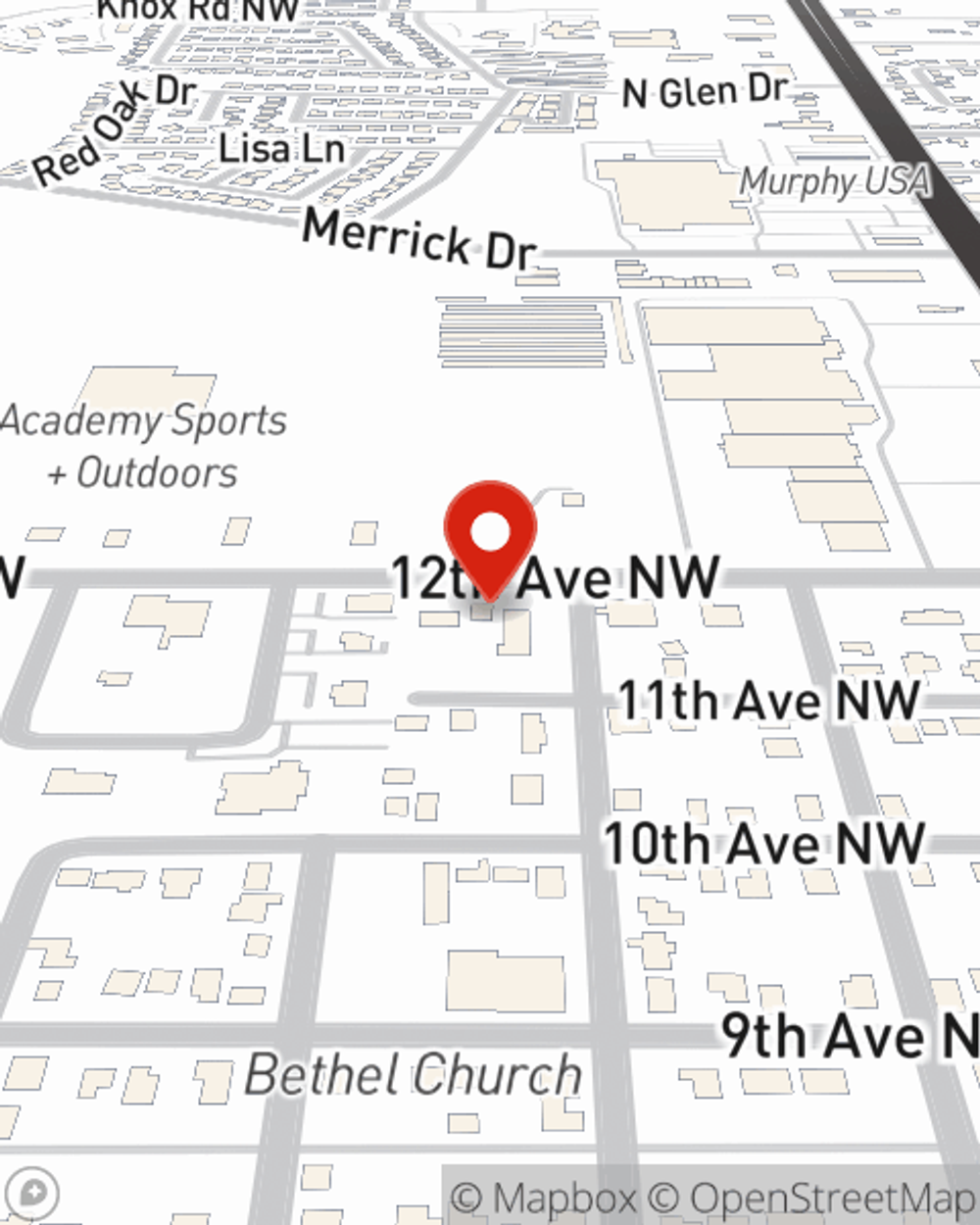

Renters Insurance in and around Ardmore

Ardmore renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

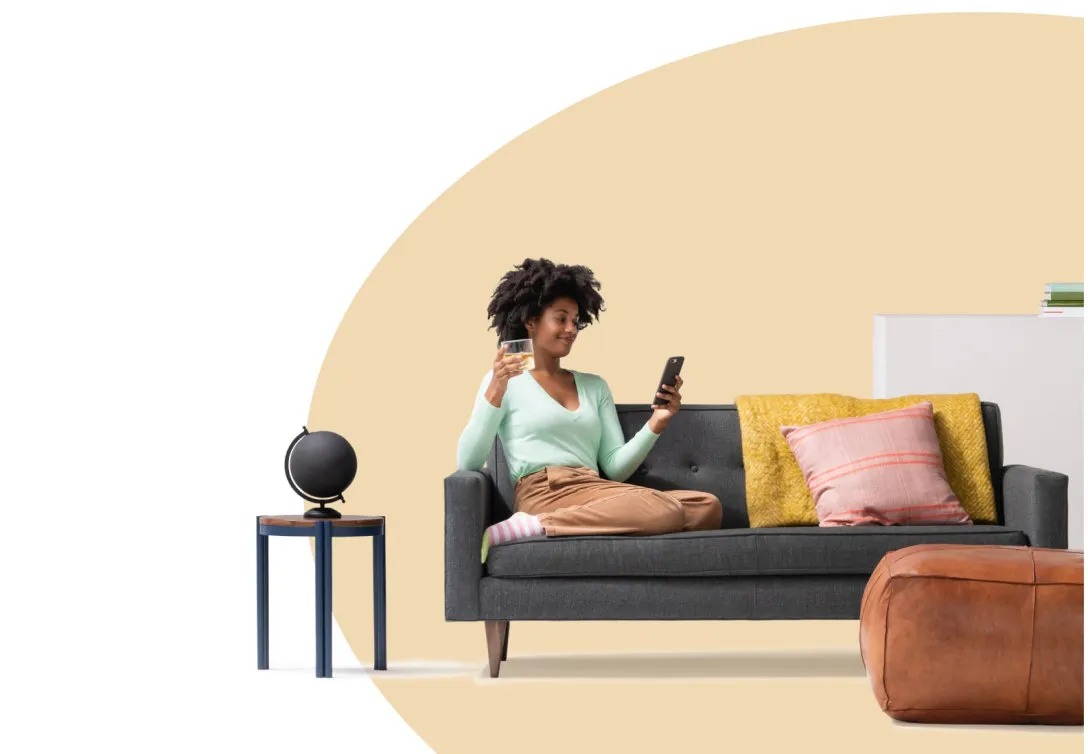

There's a lot to think about when it comes to renting a home - price, number of bedrooms, utilities, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Ardmore renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Agent Paula Bush, At Your Service

When the unpredicted fire happens to your rented apartment or home, usually it affects your personal belongings, such as a TV, an entertainment system or a tool set. That's where your renters insurance comes in. State Farm agent Paula Bush is committed to helping you examine your needs so that you can keep your things safe.

It's always a good idea to make sure you're prepared. Get in touch with State Farm agent Paula Bush for help getting started on coverage options for your rented property.

Have More Questions About Renters Insurance?

Call Paula at (580) 226-2706 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.